Customers first!

Mbanq, the Silicon Valley-based digital banking technology innovator has conducted a Customer Satisfaction Survey as part of its annual audit and ISO 9001:2015 Quality Management System recertification.

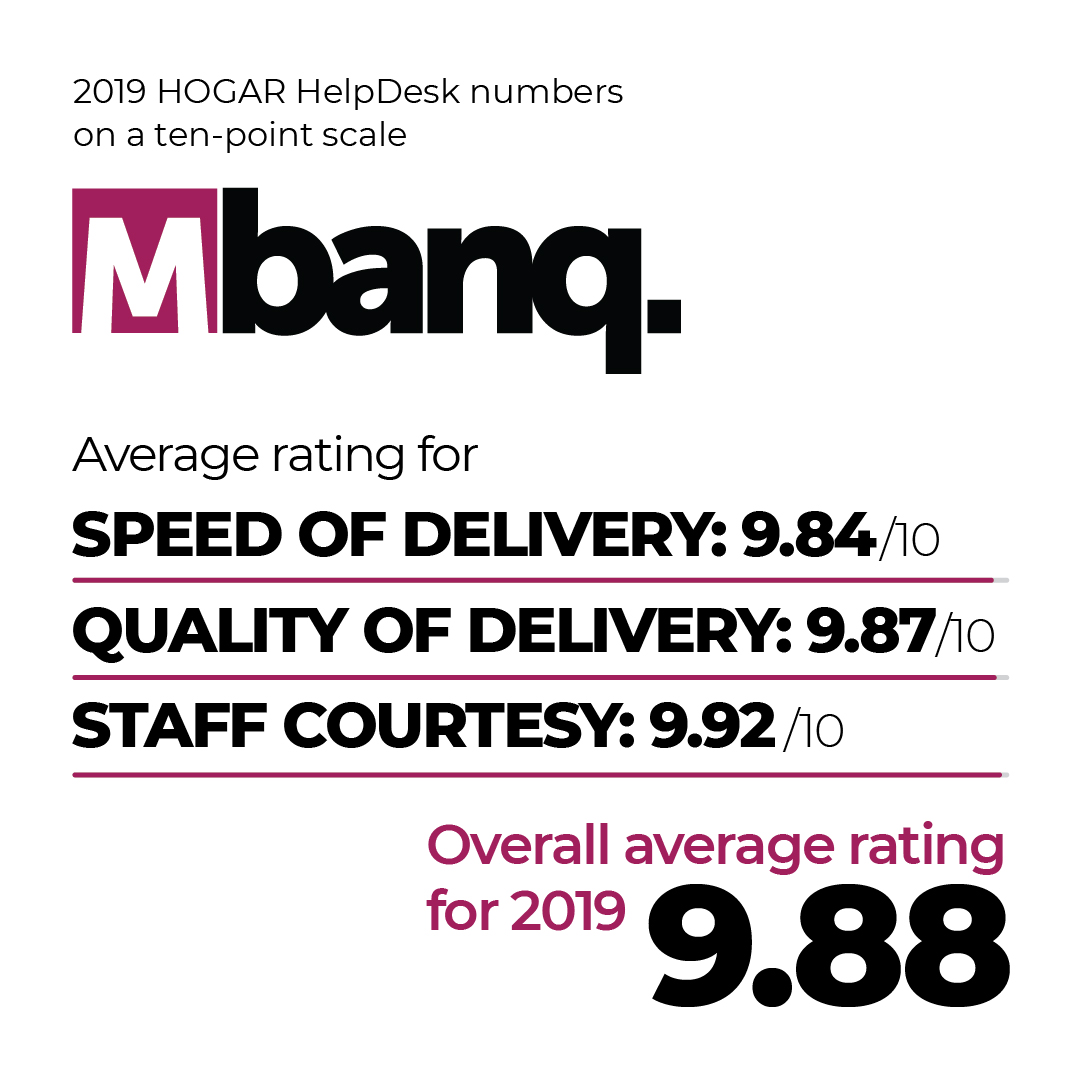

Mbanq’s clients expressed extremely high levels of satisfaction with customer support and rated Mbanq’s overall service delivery at 9.88 on a ten-point scale for all support tasks performed in 2019.

Vlad Lounegov, CEO of Mbanq, says,

“Mbanq is a trusted long-term partner that enables banks, credit unions and financial institutions set up and operate their entire bank on a digital core that is at the pinnacle of modern technology. This year’s survey shows that Mbanq’s commitment to service goes beyond the merely transactional aspects of running a bank.”

Survey key findings:

Survey participants consisted of financial institutions, traditional banks and challenger banks who are Mbanq clients. The survey analyzed all tasks completed through Mbanq’s HelpDesk system.

On average Mbanq delivered between 218 and 463 different change requests per client throughout 2019. Each was rated on a scale out of ten:

– Average rating for speed of delivery: 9.84

– Average rating for quality of delivery: 9.87

– Average rating for staff courtesy: 9.92

– Overall average rating for 2019: 9.88

“Client feedback is astonishingly positive and our own numbers will be hard to beat next year. Nevertheless, I am confident that Mbanq’s digital banking core will continue to lift client banking operations into the sky.

The key has been to listen closely to what customers actually want and to use decades of top-level industry expertise and banking intelligence to focus on real solutions. This makes Mbanq a great partner to work with,”

Lounegov adds.

Mbanq is a universal digital banking platform for traditional banks, neo-banks and FinTechs. It provides a fully compliant, vertically integrated solution that covers the entire range of banking products for retail and corporate clients, with front-to-back office functionality including finance, treasury and regulatory reporting. Mbanq connects both to traditional payment rails like ACH, SWIFT and SEPA as well to the newest rails like IBM World Wire.

Mbanq’s technology is present in banks and credit unions across the US, Europe and Asia. The company has 150 employees and offices and development centers around the world, including San Francisco, Miami, Singapore, Croatia and Germany.

Follow us in social networks to get news faster