COMET

AI-Powered Digital Lending Platform

Mbanq Comet seamlessly integrates with any banking core, transforming lending with AI-driven credit decisioning, digital onboarding, and smart loan servicing

COMET

AI-Powered Digital Lending Platform

Mbanq Comet seamlessly integrates with any banking core, transforming lending with AI-driven credit decisioning, digital onboarding, and smart loan servicing

Advanced credit scoring for faster loan approvals

Reduce defaults with precise risk assessment

Optimized loan servicing with real-time insights

End-to-end solution for the entire credit lifecycle

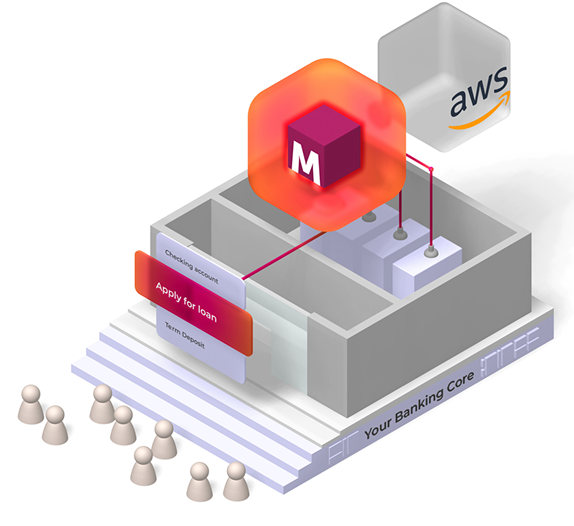

Technical Infrastructure

Fast and seamless integration, delivered by Mbanq

API-Driven Connectivity

Mbanq Comet integrates seamlessly with your CRM, core banking system, and other essential tools via secure APIs, enabling real-time data transfer and efficient loan information management

Customizable UI/UX and embeddable widgets

Allows lenders to integrate credit processes easily into existing applications. Credit products appear native to the lender’s app to improve user engagement and ease of use

Secure Hosting on AWS

Hosted on Amazon Web Services (AWS), Mbanq Comet ensures high security, availability, and scalability

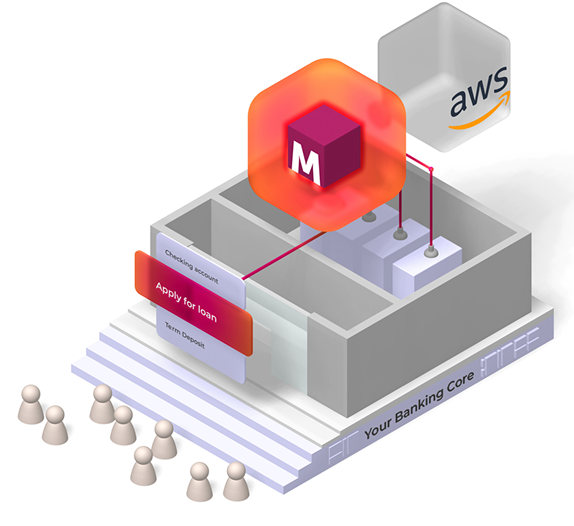

Technical Infrastructure

Fast and seamless integration, delivered by Mbanq

API-Driven Connectivity

Mbanq Comet integrates seamlessly with your CRM, core banking system, and other essential tools via secure APIs, enabling real-time data transfer and efficient loan information management

Customizable UI/UX and embeddable widgets

Allows lenders to integrate credit processes easily into existing applications. Credit products appear native to the lender’s app to improve user engagement and ease of use

Secure Hosting on AWS

Hosted on Amazon Web Services (AWS), Mbanq Comet ensures high security, availability, and scalability

Benefits

Accelerate Market Entry

Launch lending products faster with our plug-and-play platform

Maximize Approval Rates

Use AI-driven credit decisioning to identify creditworthy applicants

Optimize Customer Acquisition

Convert more users with frictionless digital onboarding

Increase Operational Efficiency

Automate compliance, underwriting, and servicing to reduce manual processes and costs

Scale Without Limits

Adapt workflows, pricing models, and risk strategies as you grow

AI-Optimized Borrower Experience

Mbanq Comet goes beyond traditional lending by intelligently tailoring each step of the application process. Our advanced Al algorithms analyze hundreds of attributes to enhance onboarding and underwriting, ensuring each borrower’s journey is optimized for speed and compliance

AI-Optimized Borrower Experience

Mbanq Comet goes beyond traditional lending by intelligently tailoring each step of the application process. Our advanced Al algorithms analyze hundreds of attributes to enhance onboarding and underwriting, ensuring each borrower’s journey is optimized for speed and compliance

Why Choose Mbanq Comet?

As a product of Mbanq, a leading FinTech and banking technology provider, Mbanq Comet combines state-of-the-art AI insights, seamless integrations, and fully digital onboarding for future-ready lending. Designed to meet the lending demands of tomorrow, Mbanq Comet is the future of AI-powered lending for financial institutions.

Why Choose Mbanq Comet?

As a product of Mbanq, a leading FinTech and banking technology provider, Mbanq Comet combines state-of-the-art AI insights, seamless integrations, and fully digital onboarding for future-ready lending. Designed to meet the lending demands of tomorrow, Mbanq Comet is the future of AI-powered lending for financial institutions.

Ready to Redefine Digital Banking?

Partner with Mbanq for comprehensive, scalable financial solutions tailored to your business goals. Share a few details about your vision, and our team will reach out promptly to explore how we can help you succeed.

Ready to Redefine Digital Banking?

Partner with Mbanq for comprehensive, scalable financial solutions tailored to your business goals. Share a few details about your vision, and our team will reach out promptly to explore how we can help you succeed.